4 Easy Facts About Forex Spread Betting Shown

Wiki Article

Excitement About Forex Spread Betting

Table of ContentsThe 10-Second Trick For Forex Spread BettingNot known Details About Forex Spread Betting About Forex Spread BettingThe Buzz on Forex Spread Betting

By remaining informed regarding what events may cause money sets to become much less fluid, you can make an educated prediction as to whether their volatility might boost, as well as thus whether you could see a higher spread. Damaging news or unforeseen financial information can be challenging to prepare for.

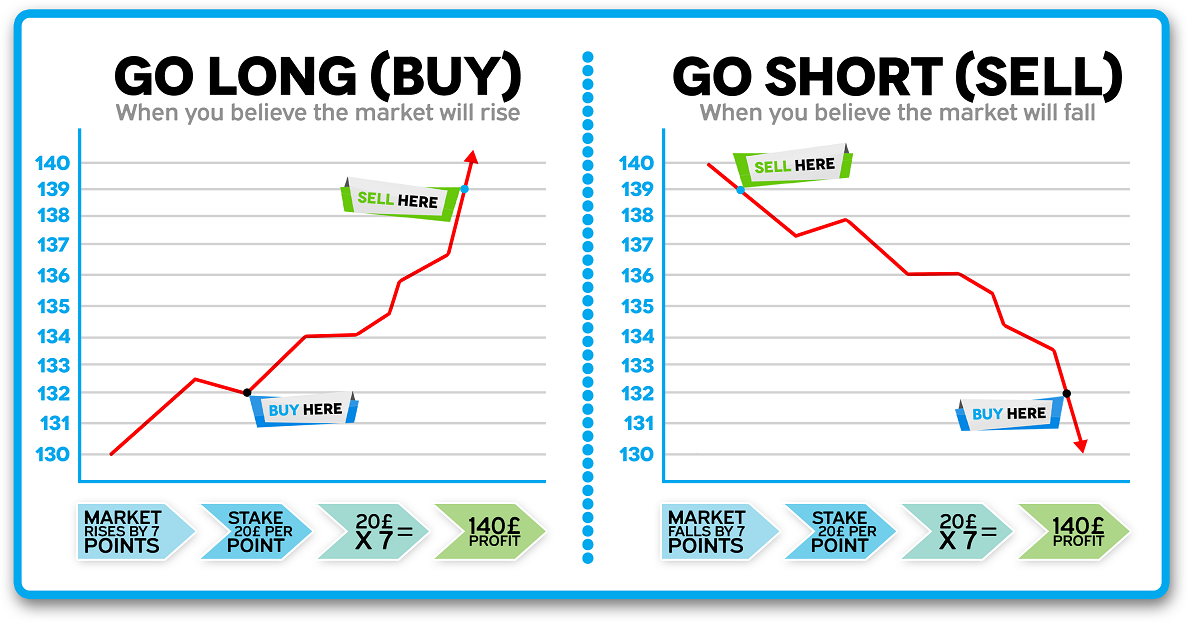

Spread wagering is a kind of fx trading that includes hypothesizing on changes in the motions of currencies without in fact trading them. There are 3 major parts to a spread betting technique, which are the direction you anticipate the profession to relocate in, the size of your wager, and the spread of whatever you're speculating on.

For instance, if you assume the euro will enhance in value versus the united state buck, you can put a spread bet based upon that expectation without in fact trading the money set. Brokers offering spread betting normally estimate two prices, the proposal and the ask, which is called the spread. Traders after that put wagers on whether one money will increase or drop versus the other.

The Greatest Guide To Forex Spread Betting

One of the benefits of spread wagering in the forex market is being able to make use of take advantage of to put your wagers., which is the amount of funding needed to finance the bet, rather than the entire quantity of the bet.It provides you a possibility for making even extra profits on your bets than what you can afford outright, it additionally suggests you have a higher opportunity of losing more money than you would otherwise. When placing a spread bet, you don't in fact acquire or market the money you are banking on.

The money will usually be the currency where the spread wagering company lies. A few of the most popular spread betting methods utilized in foreign exchange investing are pattern adhering to, hedging foreign exchange, forex scalping, as well as news trading. Foreign exchange scalping involves buying as well as offering a money set and just holding the placement for a couple of secs or mins, taking benefit of changes in the rate.

Investors make use of spread out wagering for various other financial investments besides foreign exchange. For instance, financiers can put bets on whether a supply and crypto will go up or down, wagering a specific amount on just how much the cost relocations. Traders can speculate on moves up or down by a dollar, positioning down $100 on every $1 action.

Not known Facts About Forex Spread Betting

Spread betting is just one of one of the most popular means to trade forex due to the fact that it doesn't need you to buy or market any currency. Any type of investor who desires to guess on the foreign exchange or crypto markets can transform a tidy revenue. Still, it's also crucial to bear in mind that it's possible to lose money also, simply like any type of various other investment bet.* Tax obligation treatment relies on private circumstances and can transform or may differ in a jurisdiction aside from the UK. CMC Markets is an execution-only company. The product (whether it states any kind of viewpoints) is for general info objectives only, as well as does not consider your personal circumstances or objectives.

No viewpoint offered in the material makes up a suggestion by CMC Markets or the author that any type of particular financial investment, safety and security, deal or financial investment strategy is suitable for any type of particular person. The product has actually not been prepared according to lawful needs developed to advertise the self-reliance Click This Link of investment research study. Although we are not specifically stopped from dealing before providing this material, we do not look for to capitalize on the product before its dissemination.

If you believed that GBP would come to be more powerful against USD, you would "acquire", as that implies you assume that you'll require more bucks to purchase a solitary extra pound in the close to future. On the other hand, if view publisher site you believed that GBP would weaken versus USD, you would certainly pick to "sell", as you assume that you'll require less dollars to purchase one extra pound.

The Basic Principles Of Forex Spread Betting

Consider this example. You open up a lengthy placement on a share worth 100, wagering 10 per point of higher movement as you believe the share will certainly rise in worth. If the share then increases to 105, you'll make a 50 earnings, as that's 10 per point times the 5 points it boosted by.Conversely, you can likewise select to spread out bank on a check it out reduction in value if you think that's what will certainly occur. forex spread betting. When researching spread betting, you may also have discovered one more trading alternative called agreements for distinction, or CFDs. While there are similarities in between the 2, there are essential differences in between spread wagering and CFDs.

That implies, while your professions are still based upon predicting future cost movements, a CFD is essentially the matching of getting the asset you purchase. Spread wagering just includes forecasting the future movement of an asset without owning it at all. The other key distinction between the 2 is their tax obligation therapy.

Report this wiki page